India as a country is a beautiful blend of diverse cultures, heritages, lifestyles and people. One of the underlying threads that helps keep it all together is the peoples deep appreciation and passion for music. Indians on average listen to 19.1 hrs of music every week[1]. The majority of the indian population is the youth under 25,with easy access to a smart phone and the cheapest cellular data rates in the world! It is no surprise then that music streaming industry in India is poised to make a big splash and has a huge untapped market of 1 Billion+ listeners waiting.

This has led to the entry of multiple companies into this domain such as Saavn ( now JioSaavn) , Gaana, Spotify, Youtube Music, Amazon Music, Airtel Wynk, Apple Music, Google Play Music (to name a few.)While each one of these brands fulfills the need for on-demand music; they all have their own USP’s which makes their adoption drastically different.

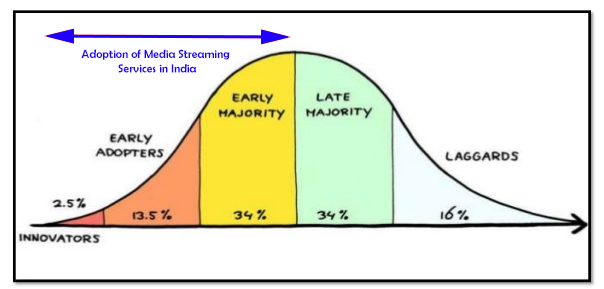

Adoption of Music Streaming Services in India

Music streaming services in India follow the traditional product adoption life cycle consisting of innovators, early adopters, early majority, late majority and laggards. While the introduction of these services started as early as 2010 ( Saavn & Gaana ) it is only now in 2019–2020 that services like these have been adopted by the mass market and crossed the chasm to become a staple on most smartphones. 97% OF Users use their smartphones to listen to music, of which 62% use either social media or an app[1]

User Profiles

- Innovators

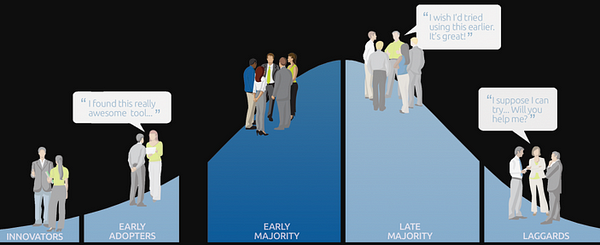

This group is the first to try out any new app or product. They are usually very passionate about trying out new and innovative things and dive straight into buying / installing the app and digging into all its features and offerings. In the music streaming industry,this would include the youth between 15–25 yrs who are still studying or have just started working. This group would include music aficionados, tech enthusiasts and those looking to discover new genres of music. This would mostly include millenials and urban dwellers.

2. Early Adopters

The second group is of early adopters. This group overlaps between 18–25 years age group and is more discerning before making an offering a part of their app portfolio. This group is known to absorb the inputs from the innovators and on the basis of their own experience with the product adopt it into their lifestyle. They are called early adopters since they start using the product at a phase in its lifecycle, where its still a niche offering and hasn’t reached mass appeal yet.This group would include young college students, professionals and perhaps advocates from other geographical markets ( Europe, Americas )

3. Early Majority

Once a product reaches the early majority phase of adoption, it is on the upswing and on a good growth trajectory. In case of music streaming services, there is a healthy appetite in the mass market of India for this offering[1]. Uptill 2016, the chasm for this industry had been the data rates and internet penetration in India. Post 2016 and the introduction of Jio,the entire landscape has changed and the chasm has shrunk into a minor pothole. Having received the “seal of approval” from early adopters, the early majority tends to evaluate a product on its ROI basis value/price. Since the industry has now adopted a freemium/ad-model, ironed out most bugs and incorporated many personalization features, OTT music services have found many adopters in the early majority. This group tends to be frequent smartphone users between 20–35 years; students and working professionals looking for easy access to their music of choice,personalization and market-entry offers & discounts.

4. Late Majority

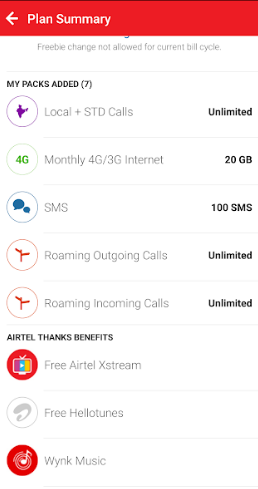

The late majority constitutes a significant 34% of a products market. This group tends to adopt products only after they have been tried and tested and perform as per expectations. This is typically a more conservative & older audience around 35–50 years and from Tier II and III cities. This group won’t go out and pro-actively adopt a new offering unless motivated by a strong advocate, discount or as a bundled service ( eg. — Airtel offers Wynk on specific subscription plans, Amazon Music is available with Amazon prime etc.)

5. Laggards

The last group to adopt a product are the laggards. This group is usually of the older demographic who are happy and content with the way things are functioning already. This group is acclimated with their current way of doing things and music isn’t a big priority for them. They either don’t listen to music frequently or prefer listening on equipment they can relate with ( stereo player or the radio)This group would usually resonate with the older era of music, hence features like music discovery and exploration wouldn’t appeal to them. If your product is being adopted by the laggards in the market, its time to roll out a new innovative version.

Factors Affecting Adoption of Music Streaming Services in India

Music streaming services attribute their adoption to 2 key macro factors —

External Factors :

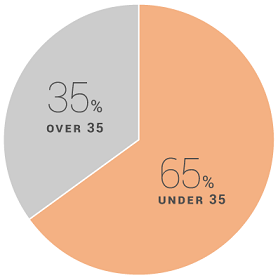

- Demographics: Streaming services are used either as apps on a smartphone, computer or an app on an IOT product such as Google Home or Amazon Echo etc. In the Indian context,both of these technologies are predominantly operated by the younger demographic < 35 yrs.

- Easy of Access: With the availability of budget friendly smart phones in the Indian market, almost 1 in every 3 Indian has a smart phone. As per latest studies conducted there are 500 Mn+ Smartphone users in India and growing at 10%+ p.a.[2] This easy availability of a medium for streaming platforms greatly helps is mass adoption of the brand and also preempts companies to delve into content localization to improve their stickiness.

3.Decreasing Data Rates & Increasing Penetration : India has the lowest mobile data prices in the world. 1gb of mobile data in India is priced @ $0.26 where as the global average is @ $8.53 [3] Considering the average monthly income of $140 in India( as per the GOI per capita income statistics ), one can see how mobile data has become an affordabile commodity for the average Indian. This is not only true in the urban area, but has also penetrated deeper into Tier II, III cities and rural India. This scenario was a lot different before 2016, but with the introduction of the highly disruptive JIO telecom services, data rates in India have seen a sharp decline in per gigabyte prices[3]and drastic increase in internet penetration in the country

4. Government Policies : Since the Demonetization drive of 2016, the GOI has been aggressively pushing for greater digitization across India. From payment wallets, UPI to digital document lockers there has been a thrust to grow and improve the digital infrastructure in India. These initiatives by the government have been strongly supportive in adoption of the “internet for service” model across the masses, both urban and rural.

Internal Factors :

- Product Features: When you have multiple products at the same price point and service quality; fulfilling the same purpose, which one do you choose to go with? This decision comes down to the products features. Spotify has its Background Play feature, JioSaavn lets your download songs, Gaana and Wynk let you see the lyrics while your listening to music, Youtube Music lets you sync across devices etc While there may be overlaps across brands, the product that pulls this off best is the one thats adopted the fastest.

- Catalogue : Users are going to accept a music streaming app, only if it has the kind of music they enjoy listening to. Hence the size of the catalogue makes a big difference in product adoption. Within the Indian context, its important to have a strong catalogue of regional and vernacular songs, to ensure deep penetration into the sub-continent audience.

- Cost of Subscription : The average Indian user is very value/Price conscious. For the past 10 years, rampant piracy and free music videos on Youtube have tempered the buyer to think along the lines of “ It has always been available for free, why should I pay up now?” This makes it challenging to find the right balance between the price point Vs Premium service. In this regard, most brands have adopted the freemium + ads based model to generate revenue and retain users. Transitioning the mindset of the user from an “always free” towards a “pay to play” model is a challenge the brands need to solve in the coming times.

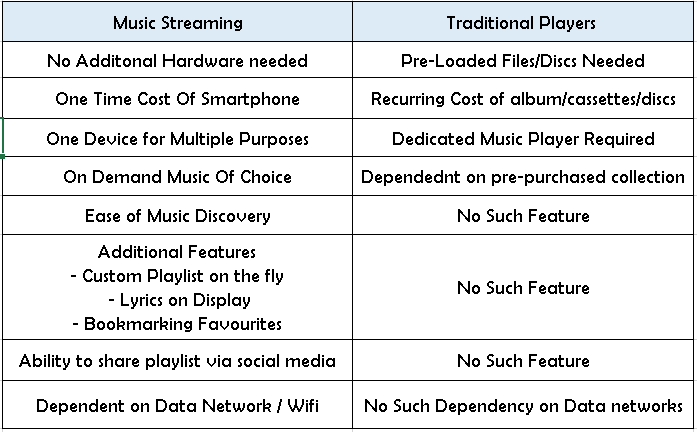

Music Streaming Vs Traditional Medium(MP3 players/cassettes/discs)

Players in the Market

There are multiple player in the industry both domestic and international.

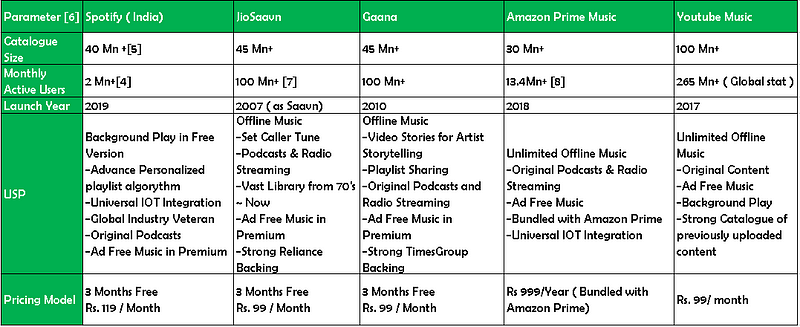

Below is a comparison of the big players in the indian ecosphere.

Growth Hacks

- Mass Marketing : In an industry where competition is stiff, the differentiating factor in a products consideration against the competition relies on brand appeal and recall. Spotify and Gaana have understood this and not shied away from investing in mass marketing via multiple TV ads. Gaana with its Times group funding has invested in TV advertisements with catchy tunes and leveraged the “gaana” term to instantly associate music with their app in the minds of the average indian. Spotify too has invested in serialised TV ads, with popular Indian celebrities to strike a chord with viewers entertainingly while also subtly showcasing the products unique features and offerings.

2. Bundled Offering : Many players of the industry offer Music Streaming Services bundled with their core offerings. Amazon Music is a complementary offering along with an Amazon Prime membership. Airtel Wynk is offered as a complementary offering along with specific Airtel prepaid ,postpaid, broadband and DTH subscriptions. Youtube Music is offered as an addon with Youtube Premium. This strategy is effective in attracting on-the-fence users from discovering, considering and eventually adopting

3. 3rd Party Reward Redemption : In these gamified times, users expect some reward/gratification for every digital activity they accomplish. Apps like CRED ( credit card payments ), Flipkart ( Flipkart Coins ) , Times Prime etc provide users virtual credits for every activity they perform — Credit card payment, online purchase etc. These credits can then be redeemed for different coupon vouchers and freebies. Gaana has tapped into this segment and provides a 90 day subscription of its premium service in exchange for these credit points.

4. Use Influencer Marketing : Studies have shown that influencer marketing can yield an mROI of 500% +[9] for digital products. Most of the apps in the music streaming space are geared towards the under 35–35 years market, more specifically the 18–25 age band. These users are highly social and plugged in to the latest going ons in pop culture. By leveraging influencers in relevant interest spheres of the prospective user ( tech,cooking, music, dancing etc) brands can introduce their product to new customers and quickly gain a foothold in markets where traditional digital/print/offline messaging has not been able to convert.

Summary

India is a developing economy of 1.3 Bn strong individuals. With 60%+ being the youth,there is a strong potential market present for music streaming services to grow and thrive. Many domestic and international players have tried to enter this segment since the 2010’s but it is only in the past 4 years that real tangible movement has occurred. Multiple policy level,commercial and infrastructural shifts have provided space to the music streaming industry in India to have a fighting chance of developing and becoming a viable business and revenue source for brands.

The market conditions and the mindset of the Indian demographic at this time is primed for adoption of music streaming services at a mass level. There is ample awareness and knowledge at the base level about these products, and what brands need to do now is give the potential customer that extra incentive /push to “try” the product; at least once. With 1 Bn+ potential customers hanging on the line and stiff competition from the opposition, the brand that understands and syncs with the cultural diversity and aspirations of the diversity of India,will be the one to cross any potential chasm, and be adopted by the majority ( both early and late )

_________________________________________________________________________________

Sources:

[1] Indian Music Industry Study 2019 ( https://www.ifpi.org/downloads/Music-Listening-2019.pdf )

[2] TechArc Report 2020 ( https://techarc.net/techinsight-at-502-2-million-smartphone-users-its-time-for-smartphone-brands-to-turn-towards-services-in-2020 )

[3] BBC News Article- Mobile data: Why India has the world’s cheapest (https://www.bbc.com/news/world-asia-india-47537201)